What is a Bank Balance?

- By Trusha Desai

- •

- 03 Aug, 2015

- •

August 2, 2015

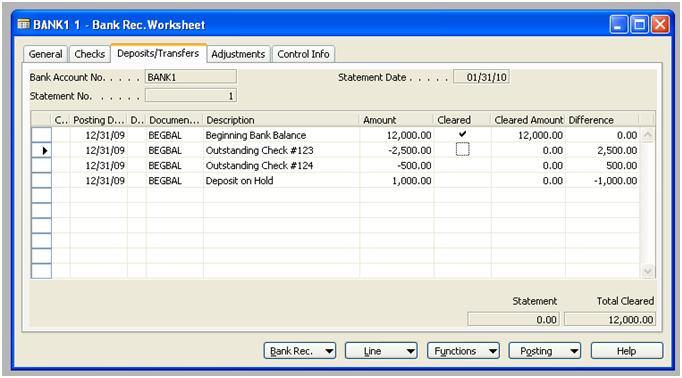

Have you wondered why your bank balance does not reconcile with your balance sheet? What is the difference? Some months it is higher, or lower, but a difference remains nonetheless.

As a business owner it is imperative to know that when you check your bank statement and see your bank balance, what you see is not what you get. There are outstanding cheques: in other words, cheques that you may have written, but have not yet cleared the bank. There are deposits on hold: that is, deposits made in the bank and yet not cleared by the bank for your bank may have different policies and procedures for how long a deposit remains on hold. Again, you have to identify whether a deposit was made at the ATM or via your smartphone or in person at the bank. There are different policies based on your relationship with the bank, and the bank's policies. If you have been a long-standing customer, you may have a greater leeway than if you have recently opened an account.

Of course, there are invisible bank service charges and interest earned that show up at different times of the month.

Therefore, this is where I come in: it is imperative that I reconcile your bank statements and credit card statements on a monthly basis. Please check out my other website #TrushaDesai.com

As a business owner it is imperative to know that when you check your bank statement and see your bank balance, what you see is not what you get. There are outstanding cheques: in other words, cheques that you may have written, but have not yet cleared the bank. There are deposits on hold: that is, deposits made in the bank and yet not cleared by the bank for your bank may have different policies and procedures for how long a deposit remains on hold. Again, you have to identify whether a deposit was made at the ATM or via your smartphone or in person at the bank. There are different policies based on your relationship with the bank, and the bank's policies. If you have been a long-standing customer, you may have a greater leeway than if you have recently opened an account.

Of course, there are invisible bank service charges and interest earned that show up at different times of the month.

Therefore, this is where I come in: it is imperative that I reconcile your bank statements and credit card statements on a monthly basis. Please check out my other website #TrushaDesai.com